Software

Cloud-Based Tax Software Built for Today’s Tax Professionals

Maximize Your Efficiency with Tax Pros 360 Software

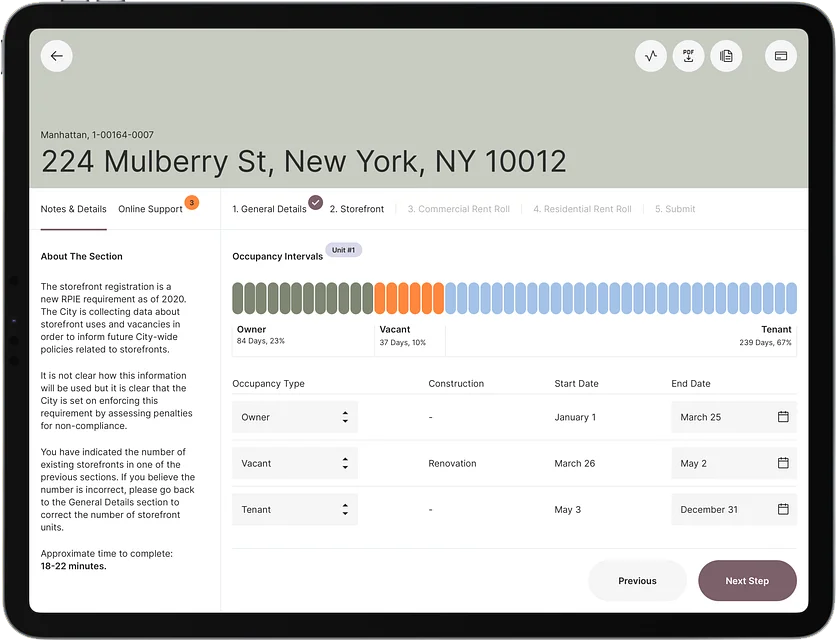

Seamless E-Filing Solutions

Experience hassle-free e-filing with our intuitive software,

designed to save you time and ensure accuracy.

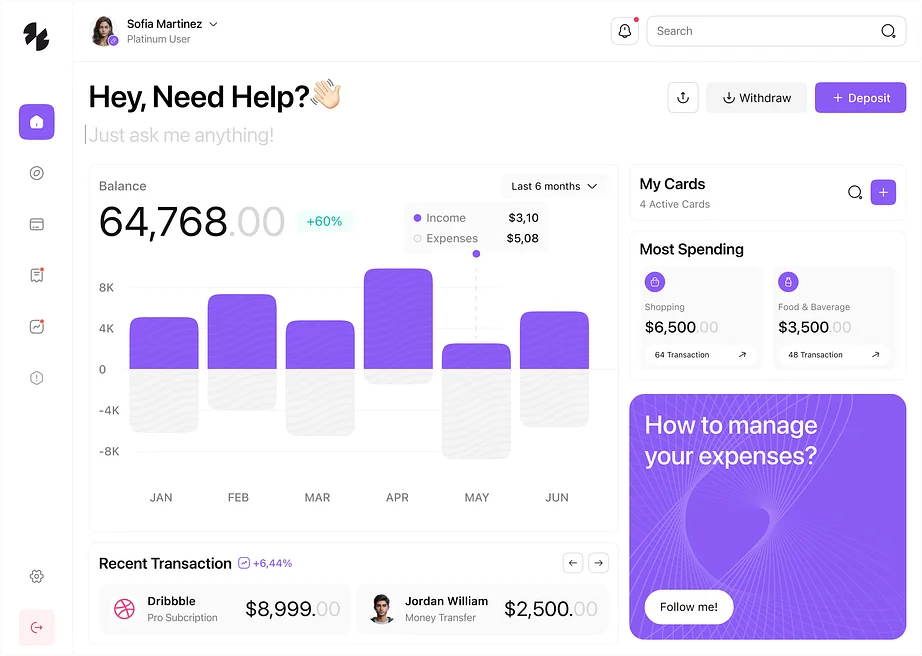

Powerful Reporting

Generate detailed, insightful reports effortlessly with our advanced tax software, designed to enhance accuracy and efficiency.

Centralized Office Management

Effortlessly manage multiple offices with a seamless, centralized solution that boosts efficiency and enhances collaboration.

Tax Pros 360’s Features That Revolutionize Tax Preparation

Streamlined Tax Preparation

Say goodbye to complex workflows. Tax Pros 360 simplifies the entire tax preparation process with an intuitive interface and smart automation tools, saving you time and effort.

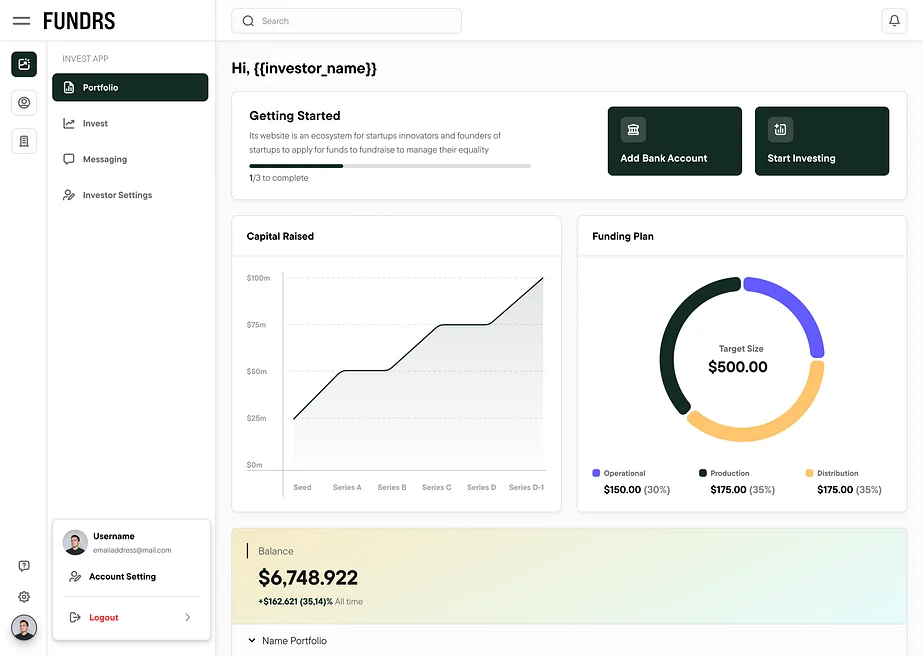

Real-Time Collaboration

Work seamlessly with your team from anywhere. Tax Pros 360’s cloud-based platform enables instant file sharing and updates, ensuring everyone stays on the same page.

Built-In Accuracy Checks

Minimize costly errors with advanced error detection. Tax Pros 360 reviews your work in real time, catching potential issues before they become problems.

Secure Cloud Storage

Your data is safe with us. Tax Pros 360 offers robust encryption and secure cloud storage, ensuring your clients’ information stays protected.

Comprehensive Tax Form Library

Your On-the-Go Tax Office Solution

What's Included With Tax Pros 360 Professional Tax Software

TaxPros360 Essential Plan

Perfect for tax professionals specializing in individual tax returns, the TaxPros360 Essential Plan provides everything you need to efficiently manage your practice and maximize profitability.

- Unlimited Individual Returns: File an unlimited number of federal and state individual tax returns.

- Comprehensive 1040 Schedule Coverage: Includes Schedule C, Schedule F, Schedule E, and Schedule H.

- 100% Earnings Retention: No fee-splitting – keep 100% of your earnings.

- Customizable WISP Templates: Ensure compliance and protect client data.

- Access to Private Community Forum: Connect with tax professionals for support and advice.

- Bonus Features: TaxPros360 Toolkit, 15-month Calendar, Practice Scenarios, Client Intake Forms, and Pre-written Social Media Posts.

Service Bureau Per Return Fee: $49.95

TaxPros360 Business Edge

Expand your services to include business tax returns with the TaxPros360 Business Edge Plan. This plan covers both individual and business filings, providing powerful tools for scaling your practice.

- Unlimited Individual & Business Returns: File unlimited returns for individuals and businesses, including federal and state filings.

- Comprehensive Business Return Coverage: Includes Forms 1120, 1120S, 1065, 1041, and 990.

- 100% Earnings Retention: Keep all your earnings with no fee-splitting.

- Access to Private Community Forum: Connect with other tax professionals for expert support.

- Bonus Features: TaxPros360 Toolkit, 15-month Calendar, Advanced Business Practice Scenarios, Client Intake Forms, and Pre-written Social Media Posts.

Service Bureau Per Return Fee: $49.95

What's Included With Tax Pros 360 Professional Tax Software

Tax Pros 360 Essentials

Perfect for tax professionals specializing in individual tax returns, the TaxPros360 Essential Plan provides everything you need to efficiently manage your practice and maximize profitability.

Key Features:

- Unlimited Individual Returns: File an unlimited number of federal and state individual tax returns.

- Comprehensive 1040 Schedule Coverage: Includes Schedule C, Schedule F, Schedule E, and Schedule H.

- 100% Earnings Retention: No fee-splitting – keep 100% of your earnings.

- Bonus Features: TaxPros360 Toolkit, 15-month Calendar, Practice Scenarios, Client Intake Forms, and Pre-written Social Media Posts.

Service Bureau Fee: $49.95 (Per Return)

Tax Pros 360 Business Edge

Expand your services to include business tax returns with the TaxPros360 Business Edge Plan. This plan covers both individual and business filings, for scaling your practice.

Key Features:

- Unlimited Individual & Business Returns: File unlimited returns for individuals and businesses, including federal and state filings.

- Comprehensive Business Return Coverage: Includes Forms 1120, 1120S, 1065, 1041, and 990.

- 100% Earnings Retention: Keep all your earnings with no fee-splitting.

- Bonus Features: TaxPros360 Toolkit, 15-month Calendar, Advanced Business Practice Scenarios, Client Intake Forms, and Pre-written Social Media Posts.